Just over half of small businesses started 2018 in the red.

New data from Xero’s Small Business Insights index reveals that just over half of small businesses started 2018 in the red.

And while cashflow is always a struggle for small business owners, in this case the culprit is a culture of late payments from larger corporations to smaller ones.

Payments to small businesses are consistently given low priority.

The study, which looked at 250,000 SMEs, showed that small businesses are consistently paid late by larger corporations. On average, a 30-day invoice raised by a small business is only paid after 46 days.

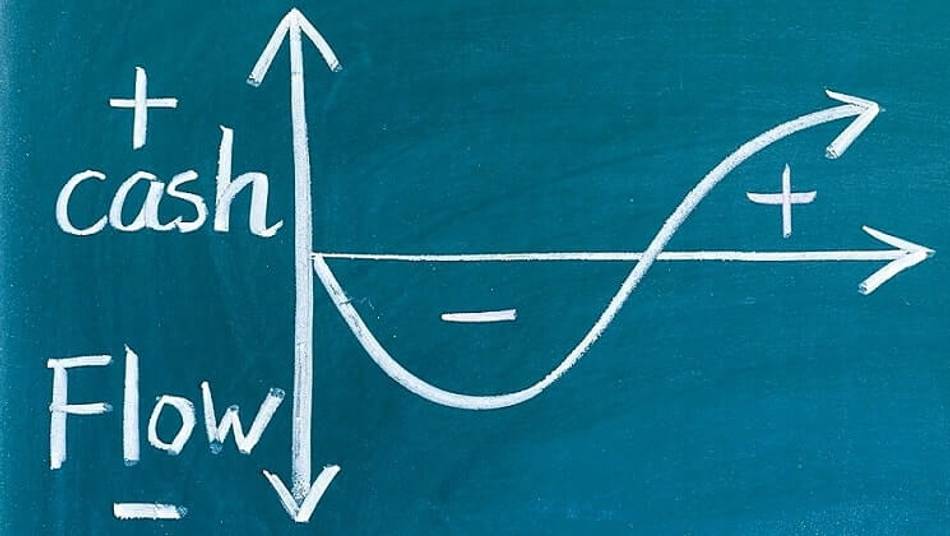

This creates huge pressure on cashflows, as small businesses are left hanging on for dear life while their clients stall.

Slow payments means slow growth

Small business owners are left with two choices. Either they operate with negative cashflow, which leaves them vulnerable to sudden shocks and unable to capitalise on new opportunities.

Or they delay investment in their business to leave room for late payments, which means they will grow more slowly than they would otherwise.

Either way, it means greater risk and slower growth for millions of small businesses, with knock-on effects on growth and employment in the wider economy.

How to boost your cashflow

While the newly appointed Small Business Commissioner, Paul Upall, is trying to tackle the problem, late payments are likely to continue for the foreseeable future. In the meantime, there are a few steps you can take to try and ease pressure on your precious liquidity.

- Hire Smart. While you might think it best practise not to employ anyone new until you absolutely have to, research shows that hiring top talent can save you money in the long run. We recently ran a series of articles about hiring apprentices, which can be a great way of attracting top talent without the huge price tag.

- Always keep a cash reserve. It’s always tempting to spend what’s in the piggy-bank, but it’s worth holding a reserve in case of emergency (and no, the release of Apple’s swanky new iPad Air is not an emergency).

- It doesn’t matter whether you do it by pen, or by Excel, or online – just make sure you have a plan for everything you’re spending. And while you’re at it, make sure you shop around for the best deals on business essentials. Sites like moneysupermarket.com and uswitch.com are great place to find good deals – as are own offerings on xln.co.uk.

- Extend payables. You’re being paid late, so bite back. Where you can, extend your payback time beyond 30 days – you can even cite Xero’s index, explaining that you yourself are waiting an average of 46 days for payment. But don’t start paying late yourself – it’ll damage your reputation and make it harder for you to procure services.